Student loans are always in the spotlight, especially during times of increasing or high inflation when the average borrower’s budget is already tight.

Though the concern over rising costs of higher education and associated borrowing rates are nothing new, recent grads, young lawyers and current students alike are feeling the sting of student loans in the context of an ever-shifting legislative environment — one in which it is practically impossible to gain sure footing in the quake of rising rates, legal challenges to the newest income-driven repayment (IDR) plan, the transfer of Public Service Loan Forgiveness (PSLF) servicing and constantly moving repayment and IDR certification due dates.

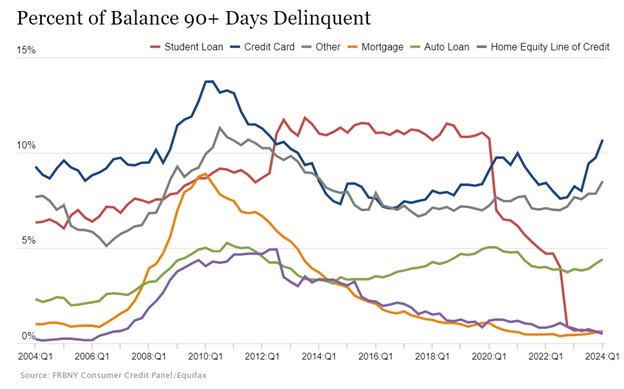

Indeed, student loans have become as ubiquitous as credit cards and auto loans, as reported in quarterly household debt and credit reports from the Federal Reserve Bank of New York. While all household debt (including mortgages) grew to $17.69 trillion in Q1, 2024, delinquency rates continued to rise for most types of consumer debt, though student loan delinquencies tell (and are perhaps hiding) a different story.

What seems like good news on the surface in this chart (the precipitous fall of student loan delinquencies) is most likely a symptom of the administrative forbearance extended to federal student loan borrowers via the CARES Act at the start of the pandemic, followed by the enactment of the Fresh Start initiative aimed at offering special benefits for borrowers and ending September 30, 2024. Only time will tell whether the steps the current administration are taking will provide sustained relief to borrowers.

When we layer in an average six-figure law school debt coupled with typical salaries ranging from $60,000 to $85,000 at smaller firms (which account for about half of the jobs taken by the class of 2020, NALP 2021), it’s no surprise that young lawyers and current borrowers are making major life decisions with the demands of their loan obligations largely at the forefront.

In fact, 80% to 90% of borrowers who completed the 2021 ABA Young Lawyers Division Student Loan Survey indicated that their student debt had “in some way disrupted the trajectory of their career or personal life.”

Specific findings showed that for those with $100k to $200k in student loan debt, 45% postponed or decided not to have children, over 55% postponed or decided not to buy a house, over 70% reported they were unable to save for retirement, and one in three with student loan debt took a job less focused on public service than they were intending prior to law school.

From a top-down perspective, the current administration is doing what it can to try and improve access and affordability with 8%-9% interest rates for federal student loans on the horizon. And from a bottom-up perspective, voting and making your voice heard on student loan issues is always a worthwhile endeavor. While the election year unfolds, it’s obvious more systemic safeguards need to be put in place to not only encourage future lawyers, but to generate a more sustainable alternative to student loan interest for the federal budget.

Here are a few strategies federal student loan borrowers can use to feel more control — and lower anxiety — as they encounter the following four life milestones:

Career path

If student loans are holding you back from pursuing your passions in a public service career, remember to read up on IDR plans and PSLF. While this program has received a lot of bad press, major steps have been taken by the administration to get it on-track in recent years, resulting in $68 billion in forgiveness for more than 942,000 borrowers to-date. And although the administration of the program is still in flux, it’s worth your time to read the PSLF Form and identify the boxes to check to potentially achieve forgiveness of your federal Direct loans after making 120 qualifying monthly payments while working for eligible public service employers.

Retirement

While IDR plans can help free up some cashflow to at least contribute to your employer’s potential matching contributions in a work-sponsored retirement plan, other options are becoming available for employers to help their associates save for retirement while paying off student loans. One such option is through the SECURE Act 2.0 student loan match, which allows employers to match student loan payments in the form of contributions to your 401(k) up to the pre-determined limits. Ask your firm if they are planning to offer this benefit and how it can help you pay down your student loans and save for retirement at the same time.

Home ownership

When it comes to buying a home, lenders consider your credit score, employment history and debt-to-income ratios (DTI), which calculate how much of your monthly income is being used to service your debts. You can keep your student loan payments in a reasonable range when compared to your gross monthly income by using an IDR plan such as Saving on a Valuable Education (SAVE) or Income-Based Repayment (IBR), which can set your monthly payments as low as $0 per month based on your reported income.

One caveat: keep in mind that many types of mortgages won’t allow lenders to include a payment of $0 per month as part of the qualifying DTI calculation and will instead use .5%-1% of your total student loan balance as the “monthly payment.” One exception is Fannie Mae conventional mortgages, which allow the lender to include the $0 monthly payment if they verify it using a student loan statement.

Growing family

Here again, IDR plans come into play. The monthly payment calculation for plans such as SAVE and IBR protects a certain percentage of your adjusted gross income (225% and 150%, respectively, of the federal poverty guidelines for your family size and the state in which you live). The more people in your family, the higher your poverty guideline — which translates to more protected income and lower monthly payments. While these payments will be based on your total household income (unless you elect to file separately), getting married and filing your taxes as married filing jointly also means a higher standard deduction and access to more joint saving and investing opportunities.

Being aware of these strategies can help borrowers decrease student loan anxiety and tackle life’s biggest decisions with more confidence. And at the end of the day, borrowers will (and should) make decisions based on their comfort level with debt, what helps them sleep best at night, and which paths support their holistic life goals.